Paul Richards 'Rich' @ Pedigree Pens Ltd. will be walking the entire 84 mile length…

Paul RichardsSeptember 28, 2012

Please feel free to download / print off our June 2012 advert for your reference:…

Paul RichardsJune 8, 2012

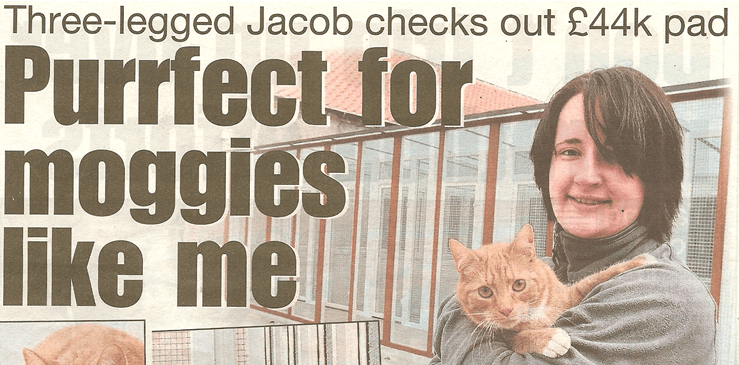

Press Release Press clipping is taken from the © Evening Gazette, Friday, April 27th, 2012.…

Paul RichardsMay 2, 2012

Taken from the RDPE Network Website © Copyright DEFRA Rural Economy Grant (REG) The Rural…

Paul RichardsApril 17, 2012

FINANCE HAS NEVER BEEN SO EASY NO CAPITAL OUTLAY ** TAX EFFICIENT SYSTEM EASY…

Paul RichardsApril 2, 2012

LEASE YOUR PEDIGREE PENS CATTERY... Leasing is not a second rate alternative to paying by…

Paul RichardsApril 2, 2012